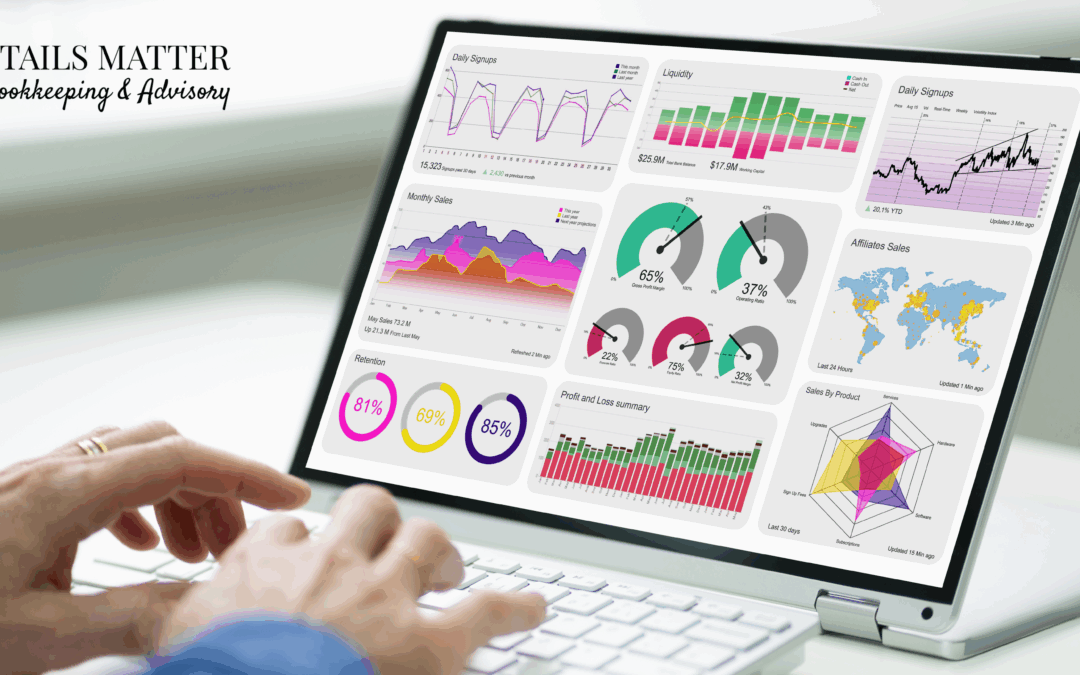

When you’re running a small business, the to-do list never ends. You’re juggling sales, staffing, operations—and somewhere in there, you’re supposed to “know your numbers.” But which numbers really matter? KPIs for small businesses are your financial dashboard....